On a monthly, quarterly, annually, or as-needed basis, your bookkeeper can format financial statements, which can be used by your accountant to analyze your current financial position. In retail or other non-office environments, bookkeepers may work in a back-office or stockroom area, away from customers and other employees. They may be responsible for managing inventory, tracking sales, and handling cash and credit card transactions. It is also the bookkeeper’s responsibility to note down all tax dates and prepare accounting books before starting tax season. Furthermore, they should be available to provide the right information and support to accountants, auditors, and other tax experts to meet all tax requirements. Depositing checks and cash receivable to the bank and writing off against the relevant invoices is on the top of the bookkeepers’ to-do list.

Transitioning from bookkeeping to accounting roles

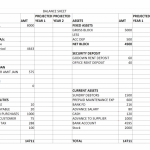

Junior accountants maintain the financial records of companies through the analysis of their general ledger accounts and balance sheets. The accountant’s post journal entries, maintain accounts receivable and payable, and update financial statements. They pay payroll every month, reconcile ledgers, https://www.business-accounting.net/how-to-create-a-business-budget-how-to-create-a/ and submit payroll taxes. The skills necessary for this job include analytical skills, problem-solving, information confidentiality, and proficiency in accounting software and technology. Bookkeepers play a vital role in maintaining the financial health of businesses and organizations.

- While there is a general overlap between the two professions, there are a few distinctions that are later discussed in this article.

- However, compensation will widely vary depending on the employer, location, and candidate experience.

- Since bookkeeping is the fundamental accounting process, therefore, you have to precisely perform all the bookkeeping responsibilities daily—without fail.

- Accounting is the process of analyzing and interpreting the financial data recorded by bookkeeping, such as preparing financial statements, tax returns, audits, and other reports.

- It is not uncommon for an experienced bookkeeper to make a career transition into accounting or another profession.

- We take monthly bookkeeping off your plate and deliver you your financial statements by the 15th or 20th of each month.

Bookkeeping tasks

Professional writers and data scientists comprise the Zippia Research Team. For example, a Certified Public Accountant (CPA) is paid more than a traditional accountant due to having to meet higher education and licensing requirements depending on their state. Take our free career test to find out if bookkeeper is one of your top career matches. After finishing work, Trish goes to pick up her child from preschool, making a few calls to clients on her drive over. Meeting over the phone, on a video call, at your favorite cafe, or your client’s office are all fine.

Run your business with confidence

Then there are sales tax payments, which must be submitted on a regular schedule. Having your bookkeeper record and categorize transactions is key to making sure those taxes are paid promptly to avoid potential fees and penalties. Modern accounting software is the repository of all financial transactions for your company and can generate requisite reports in real-time. So even if you have accounting software, odds are, you still need a bookkeeper to manage the software, enter data, file reports, identify errors and keep everything current. Since bookkeeping is the fundamental accounting process, therefore, you have to precisely perform all the bookkeeping responsibilities daily—without fail.

A Day In The Life Of A Bookkeeper – Bookkeeper Duties

Bookkeepers should research local average rates to ensure they price their services competitively. In terms of cities, the leading destinations for bookkeepers also rank among the largest metro areas in the United States. Notably, Texas has two cities (Dallas and Houston) in the top five employers of bookkeeping, accounting, and auditing clerks among metro areas. Some industry experts believe that not https://www.simple-accounting.org/ enough bookkeepers are emerging to fill available job openings, indicating opportunities for professionals with the right skills. However, keep in mind that those higher living costs may cancel out the financial benefits of increased bookkeeping salaries. Credentials like the CB and CPB certifications may also help bookkeepers develop the superior skills that boost their overall compensation rates.

Whether you are starting a career or seeking a change, start building job-ready skills in bookkeeping and accounting with Intuit’s Bookkeeping Professional Certificate and Bookkeeping Basics on Coursera. In these programs, you can learn accounting principles, accounting software, payroll, how to prepare financial statements, and more. You typically maintain accurate accounting records across all transactions while communicating with others.

Their work plays an essential role in the overall operation of a business, as they help management make informed financial decisions based on accurate financial data. Bookkeepers may also collaborate with accountants to facilitate compliance with relevant laws and regulations, contributing to the sustainability and success of an organization. There are many key differences between these two careers, including some of the skills required to perform non-cash interest expense responsibilities within each role. An accounting technician is responsible for evaluating financial information procedures to support accounting and taxation tasks, verifying the accuracy of account statements for the reference of accountants. Accounting technicians manage the payroll processes, generate invoices, perform account reconciliations, analyze account receivables, prepare budget reports, and monitor the company’s financial transactions.

They have a book where they record all that information, and then it comes to me, and I put it into QuickBooks. The good news is that there is a pretty easy workaround to the task if your client’s bank account doesn’t hook up to QuickBooks either. In order to get the transactions, you can go to the bank, select the date range you want, download it, and then you can upload it into QuickBooks from there. It’s important to do this first so we can match what feeds into the bank account. This client works off paper checks, so every month I will pick up the check stubs and enter them into QuickBooks.

Let’s explore what bookkeepers do, some of the benefits of bookkeeping, and your options for using a bookkeeper. Check out our helpful guide for deciding when is the right time for your business to invest in hiring a bookkeeper. Accountants on the other hand, go through rigorous training and standardized exams to become certified public accountants. If all your mental powers have been focused on getting your business off the ground, you might not yet fully understand what a bookkeeper does. In this guide we break down the day-to-day role of a bookkeeper, and why a good one is worth holding onto.

A seasoned small business and technology writer and educator with more than 20 years of experience, Shweta excels in demystifying complex tech tools and concepts for small businesses. Her postgraduate degree in computer management fuels her comprehensive analysis and exploration of tech topics. After completing your education, you can seek an internship and get on-the-job training to become a bookkeeper. However, it helps to have a two- or four-year degree in accounting, finance or related discipline. However, you want to at least include education, experience and licensing requirements in your job description.

By maintaining accurate financial records, bookkeepers provide essential information that managers and business owners can use for decision-making, budgeting, and forecasting. In this section, we will explore how bookkeeping supports these important functions. A bookkeeper’s primary responsibility is to record and maintain financial transactions for an organization, such as accounts receivables, accounts payables, and payrolls. They ensure that daily financial transactions, including purchases, sales, receipts, and payments, are meticulously recorded and organized.

If the company doesn’t have department heads or employees who are responsible for tracking and maintaining inventory, it might be the bookkeeper’s job to record these inventory levels. Customize plans to include other services like accounts receivable processing, inventory reconciliation and payroll support. Tasks range from categorizing bank feeds to entering checks to reconciling and sending reports to the client. Today I’m going to share with you exactly what I do each month for one of my bookkeeping clients using my own checklist.

For instance, the job outlook for accountants and auditors has a 6 percent growth rate from 2021 to 2031. The median salary for these roles is also higher than for bookkeepers at $77,250 per year [4]. Additionally, a bookkeeper may work with an accountant, who is responsible for more advanced tasks such as assessing the health of a business or generating financial statements. The bookkeepers have to send invoices via accounting software, maintain the payment cycle and remind customers about payment, deposit checks, and bill receivables and start the debt collection process. Sending checks and cash receivable to the bank and matching the same against the relevant invoices is the top of the bookkeepers’ daily tasks.